Cash and Startup

What is the relationship between Cash and Startup? How critical it is?

The sad truth is that cash-flow surprises kill many startups. Overall,

90% of small business failures are caused by poor cash flow. Put simply, not enough cash coming in the door and too much going out. Getting paid on time and managing your outgoings is critical to business success. – Dun & Bradstreet (dn smallbusiness.com)

Managing startup-cash flow is critical.

Startup business needs cash to start and more cash to grow.

Managing the cash till the business starts growing is one of the icebergs that the startups have to negotiate till outside support is possible.

6 Cash Flow Essentials for Your Startup

Managing cash collections probably wasn’t what drew you to entrepreneurship in the first place, but it’s a crucial part of running a business. At the end of the day, no business can sustain itself without cash -- this is especially true for a bootstrapped startup.

https://www.entrepreneur.com/article/240569

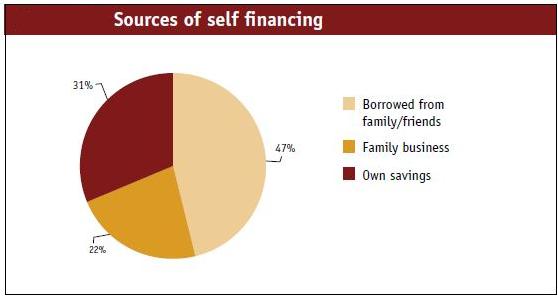

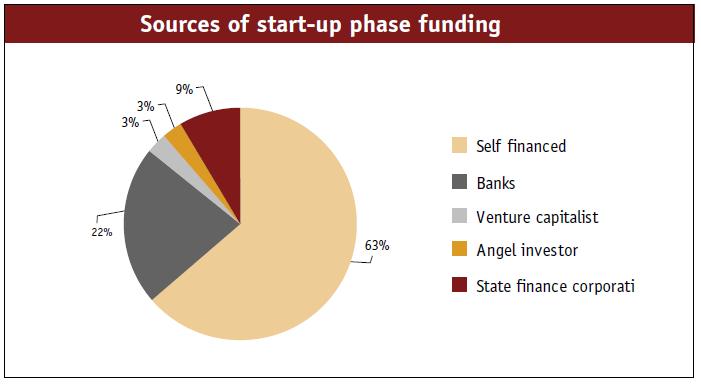

Statistics Courtesy: Gaurav Doshi- e-cell iit kanpur

Cash and Startup-Managing Cash

Startup businesses are generally funded by the entrepreneurs themselves.

The three 'F’s –Family, Friends and Fools are the sources of funds in the beginning.

Working capital loans are hard to come by without out establishing steady revenue.

Cash flow forecast by the entrepreneur is therefore important till the business can attract funds from external sources.Failing to plan may lead to business disruption.

Why do many Entrepreneurs say they have financial problems? If you turn to successful entrepreneurs for advice,they will say that the mantra is generating positive cash flow.

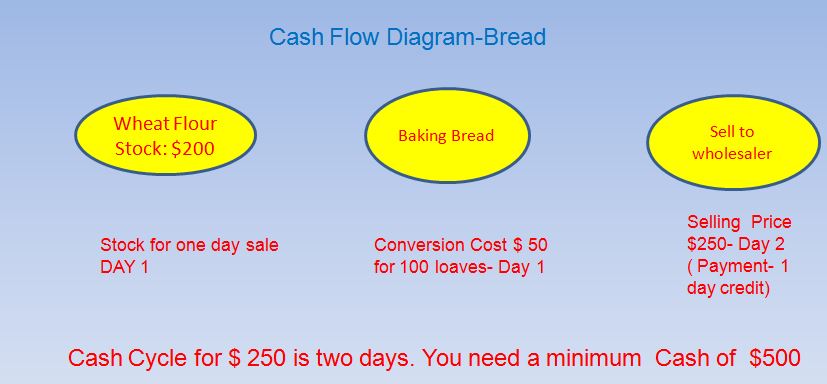

Cash and Startup-The operating cash cycle

The time gap between cash investment to cash receipt is called cash cycle.

Cash Flow planning or how your cash gets rotated is what we call operating cycle. You invest cash; get your idea converted to a product or service by using resources. Resources consume cash. The understanding of the operating cycle i.e.; how many days does it take for the cash invested to come back.

Let us take a vegetable vendor who buys tomatoes for Rs. 200 and sells it for Rs. 300 the

same day.He may keep Rs. 20 for expenses and reinvest Rs. 280 the next day and earn

Rs. 400.The vendor’s cash cycle is one day.

Cash and Startup-Cash Flow Estimation

The

entrepreneur can estimate the outflow of cash like employee salary,

administrative expenses, utilities etc fairly accurately. The inflow from sales

can vary and have peaks and valleys especially if operating on credit

sales or if the product has seasonal sales.

The operating cycle will be longer if sales are seasonal or raw materials are available only during a particular season. The longer the operating cycle, the more the cash required.

(See the diagram given in the annexure for better understanding)

Cash & Startup- How to improve Cash Flow?

Receivables

- Cash sales only if your business allows

- Advance payments along with orders

- Credit Sales only to established business

a. Tracking payment due dates

b. Sending reminder in advance for payments

Payables

- Credit from suppliers

- Negotiating volume based discounts from suppliers

- Bill discounting schemes offered by commercial banks.

- Cash discount for early payments by customers

- Just in time concept

“Number one, cash is king... number two, communicate... number three, buy or bury the competition”.-Jack Welch

Cash and Startup-Conclusion

"If you’re not making money, you’re not really running a business. To have a successful business means having a profitable business, but ultimately the real goal to stay afloat is healthy cash flow. If you don’t have enough money coming in, you won’t have enough money to pay your expenses. Avoid these cash flow mistakes to ensure that your company gets—and stays—in the black."-David Ehrenberg is the founder and CEO of Early Growth Financial Services

- Cash flow forecast by startup entrepreneur

- Optimizing the operating cycle

- Contingency Plans for peaks and valley of cash flows.

- Focus on cash and not profit