Startup Debt Financing

Startup Debt Financing as an option for growth

Startup Debt financing as an option to grow after having invested their own cash in the beginning.One of the options is to approach banks for loan. Borrowing money from banks still keeps the entrepreneurs in control unlike giving shares to a partners or seeking funds from venture capitalists.

“No loan is free. The costs are in your loan somewhere, maybe rolled into the amount to be refinanced or even coming at a higher interest rate.”-Barbara Corcoran

Source:Ecell iitkanpur-Gaurav Doshi

Debt financing keeps the party going for Startups

Source; Economic Times

Over the past six months, two prominent startups, furniture rental company Furlenco and online lending platform Capital Float, have floated NCDs to raise fresh capital from investors, potentially paving the way for other high net-worth individuals to back startups by providing debt financing, instead of equity, which has primarily been the case till date.

The past 12 months have seen the country's top three venture debt firms - IntelleGrow, InnoVen Capital and Trifecta Capital - ramp up their pace of lending. While InnoVen Capital has disbursed Rs 400 crore in 2016, Trifecta Capital has taken its capital commitments to Rs 220 crore by the end of December. Additionally, IntelleGrow has disbursed about Rs 150 crore, across 50 transactions, over the past six months.

Startup Debt Financing Options

Short term-The working capital loan

Startups-Debt Financing has two options-Short Term & Long Term.

Startups need money on short term to manage cash flow. The working capital loan is easier to get provided entrepreneurs have been transacting through that bank from commencement of the business.

They can get loan as overdraft facility against raw materials, work in process and finished goods as collateral. The interest has to be paid every quarter.

The banks renew the limits every year. Banks also expect the entrepreneurs to have t least 5 times the overdraft as the turnover.

Long term Loan

Entrepreneurs who want to acquire assets like building, machinery etc require capital. They need to submit business plan or a project report to the bank. The capital is to be repaid over a long term period of 5-7 years along with interest as EMI. The assets procured has to be offered as collateral and cannot be removed or disposed off without the bank’s approval. The entrepreneurs need to bring in 20% of the total finance required upfront.

There are also equipment lease options where they need to pay lease rentals on a monthly basis.

This helps the entrepreneurs to convert fixed to variable cost while minimizing minimizes the business risk and technology obsolescence.

Image Courtesy::geralt www.extension.org

Exceptions to Long term Loan

This loan is for

mainly asset based business. Service industry or intellectual capital based

business will not be able to get long term loan.

“We’re a software business, so it’s not like I

have a ton of machinery that can be used for collateral,” Barach says. “Bank

financing is just very hard to get, so we had to be creative about this

Startup Debt Financing-Demystifying Bank Loans

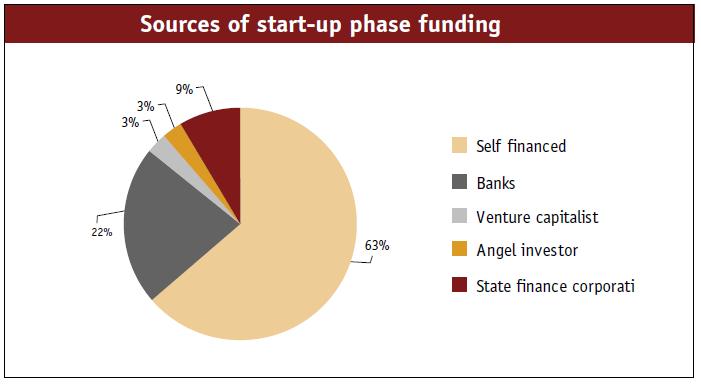

The largest

source of funding is from commercial banks for entrepreneurial ventures. The

government is keen to promote entrepreneurship and has even mandated banks to

give loan for startup enterprises without collateral.

Many a times we hear from entrepreneurs that banks are unwilling to lend them .Why are entrepreneurs not able to get loans? The main reasons according to a seasoned banker of two decades are that starts up entrepreneurs do not understand the bankers’ perspective of granting loans and as a result their project suffers.

Startup Debt Financing Bankers Perspective

They have a team which includes experts having domain knowledge to assess the viability of the business. Normally bankers lend ,based on their evaluation of project viability but the overriding concern is the assessment of entrepreneurs themselves.

Entrepreneurs’ may be wondering how the above is

determined by bankers. Is it purely the qualitative assessment of the

individual by bankers or is there a quantitative measurement available

Startup Debt Financing - Assessment-Indian Context

The

government has set up an organization called CREDIT INFORMATION BUREAU (India)

Ltd. (CIBI)

The CIBIL Trans Union Score is a 3 digit numeric summary of the entrepreneurs ‘credit history which indicates their financial & credit health The borrowers’ credit score tells the lender how likely they are to pay the loan back based on their past repayment behavior. The higher the score, the more the chance of their loan application getting approved!

The credit score can be checked for a small fee.

Startups increasingly turning to debt financing despite dangers

Source: Pitchbook

Although debt can be attractive for a number of reasons, it can also come with a certain amount of risk. If a startup is unable to achieve the amount of growth it forecasts, the debt ends up acting as more of a time bomb than growth equity.

Startup Debt Financing-Nuggets

- Working Capital loan smoothens Cash Flow

- Enables asset Acquisition

- Loan repayment Credibility

- Relationship with bankers right from the word go